Supercharge your lending.

Improve margins, increase revenue, streamline workflows, and close and fund loans seamlessly with a comprehensive cloud-based lending platform.

It’s time to replace last century’s lending processes. Today’s borrowers expect quick and easy digital experiences—and lenders need the flexibility to deploy and modify lending applications quickly. Make borrowing simple and fast for your customers with automated processes that can approve, underwrite, and fund loans in minutes—and make life easier for your staff by minimizing the rekeying of data and avoiding manual handoffs of workstreams between departments.

It’s time for your lending to move at the speed of business.

Here's how to make it happen.

SCALE YOUR LENDING EFFORTLESSLY

Transform your lending processes to build a more profitable, scalable, and responsive business.

IMPROVE MARGINS AND OPERATIONAL EFFICIENCIES

Streamline your processes and decrease the friction that both your applicants and employees experience. Your lending business will become more efficient, reducing the time it takes to process and underwrite loans—increasing margins without touching rates or staff levels.

INCREASE SCALABILITY AND REVENUE GROWTH

Don’t let legacy technology limit your capacity. Use a flexible cloud-based solution to support virtually unlimited lending. With repeatable, automated loan processes, your business can handle application volumes of 3X your historic levels without adding staff or compromising lending standards.

CREATE SEAMLESS BORROWING EXPERIENCES

Modular solutions to fit every need A salesforce-native, cloud-based platform Quick and easy loan applications Flexible, customizable lending

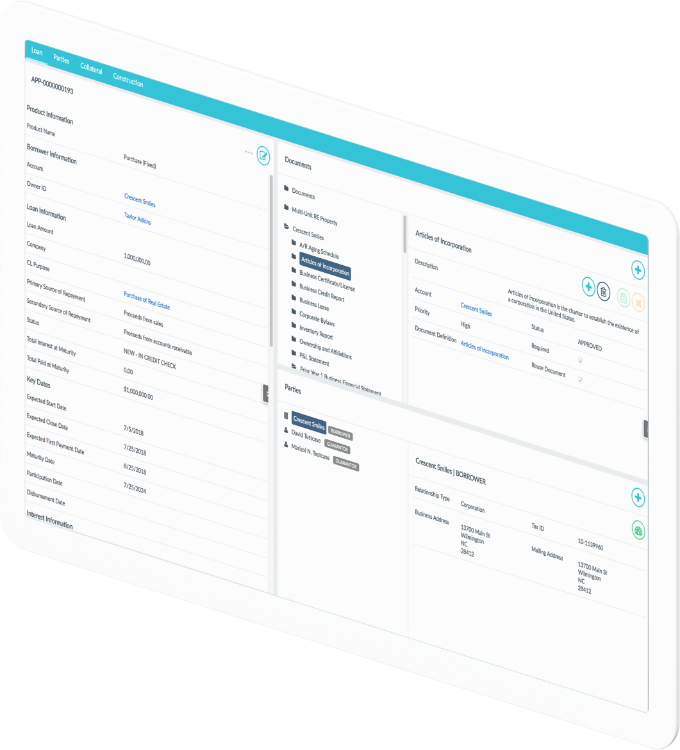

Lending doesn’t have to be complicated. Our modular platform gives you the ability to manage lending simply throughout the entire loan lifecycle, from application to collections. The result is a better experience for both borrowers and lenders.

-

Q2 Loan

Improve borrower experiences at scale with automated, cloud-based lending.

-

Q2 Collections

Maximize revenue with automated, agile, cloud-based collection processes.

-

Q2 Originate

Increase productivity and lower origination costs with auto-decisioning and compliance checklists.

-

Product Overview

Q2 Marketplace

Expand your presence in online marketplace lending with an automated, comprehensive loan management tools.

-

Q2 Lease

Easily oversee large-scale leasing operations with a cloud-based, automated lease management solution.

We have found a lending platform that is highly flexible, providing approval and loan distribution in hours and days, rather than weeks or months, and that integrates seamlessly with third-party databases.

UNPARALLELED SPEED WITHOUT RISK

When your customers need a loan, they need it now.

Don’t make them wait and don’t put yourself at risk by rushing through manual or disparate processes.

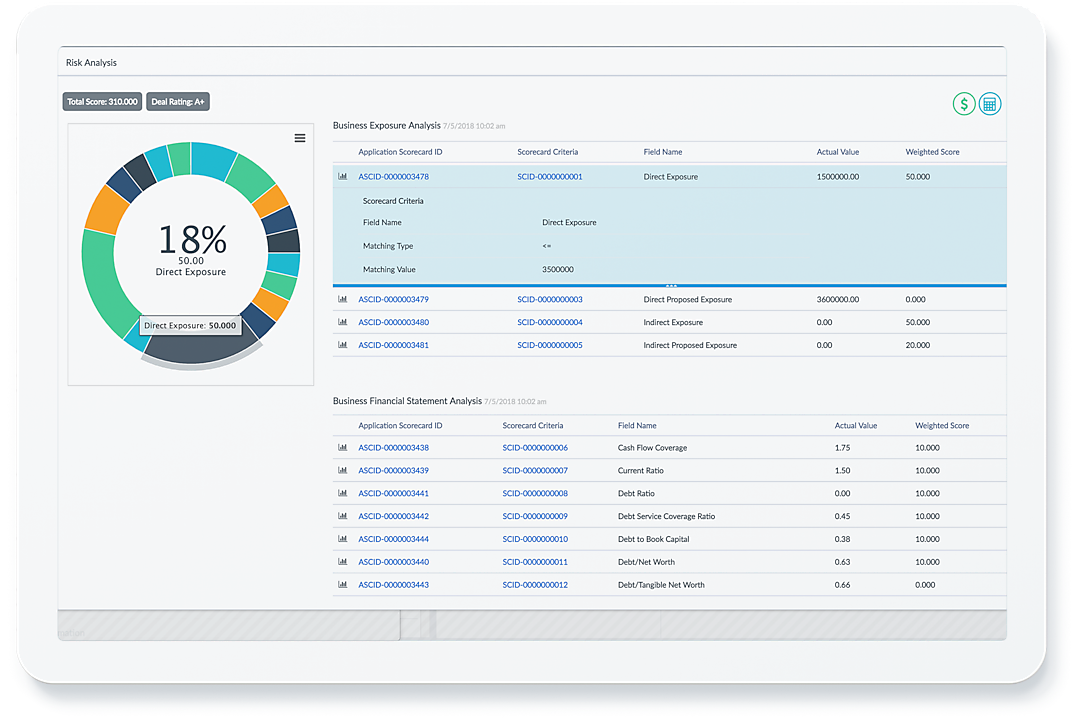

MITIGATE RISK

An inefficient lending process creates risk in the form of human error and integration failures. We remove the operational risk of data errors and the business risk of not collecting revenue due to those errors by supporting the entire lending process—from application to collections—all on a single platform.

SPEED TO MARKET, SPEED TO CHANGE

How quickly can you go live on our lending solution? We can make it happen in as little as four days. We move as fast as your business, and our low-code environment allows you to make changes rapidly, so you can quickly customize and alter loans and workflows. Need to move a field? Need to add a product? Legacy technology takes days or weeks to make these changes; we let you do it in minutes.

BUT THIS IS JUST THE BEGINNING

Lending is just one piece of a comprehensive fintech solution set. Effectively serve account holders and transform their lives with our other fintech solution set.

Embed unique banking products that drive revenue and engagement.

Through Helix, we help you take the building blocks of banking and embed them into your existing product ecosystem to create a unique offering. Add features like bank accounts and wallets, custom virtual and physical debit cards, payment management, and more to set yourself apart from the competition and provide customers the financial experiences they can’t find elsewhere.

Grow deposits and build relationships.

Acquiring new users is tough and costly, so don’t take them for granted. Build those relationships by locking down direct deposits and recurring payments. With our automated account switching solutions, it’s fast and easy to fully onboard, engage, and grow relationships.

Opportunity awaits—but not for long.

The financial services market is quickly filling up with agile non-bank brands like yours, but there’s still room for you. We can help you seize this opportunity with solutions and partnerships designed to make it simple, fast, and inexpensive to win new customers, generate additional revenue, and build more rewarding customer relationships.

You can’t do it alone—but you won’t be.

Let’s build something better.

Or call 1-833-444-3469